Imagine: you are the owner of a small but fast-growing business. You have just launched a new product, and customers from all over the world have started buying it actively. But there’s a problem: some of your customers want to pay with cryptocurrency.

You’ve heard of Bitcoin, Ethereum, and other digital assets, but you’ve never experienced using them before. How do you accept the payment? Where do you store these funds? And, most importantly, how do you do it safely and conveniently for your business?

This is where crypto wallets offer rescue. But how to choose the right wallet type? After all, there are two main types: custodial and non-custodial crypto wallets. One of them is more suitable for beginners, and the other – for those who appreciate full control over their assets.

In this article, we’ll break down what a cryptocurrency wallet is and how it works so you can easily accept, send, and store cryptocurrency. We will also help you understand the best wallet to choose from, whether it is for personal use or for business.

By the end of this article, you’ll have a clear understanding of which option is right for you and will be able to confidently integrate cryptocurrency into your business processes.

What is a Non-Custodial Wallet?

Imagine that you do not keep your savings in a bank, but in your own safe deposit box, to which only you have the private key. No one but you can access your money. This is exactly how a non-custodial wallet works. It is a digital tool that gives you complete control over your crypto assets.

How does it work?

A non-custodial crypto wallet does not save your money on outside servers. Rather, it gives you a private key and special codes that let you control your assets on the blockchain. You choose where to keep these private keys, how to use them, and when to use them.

Benefits of Non-Custodial Wallets

- Complete control: You are the sole owner of your funds. No one can block your wallet or restrict access to it.

- Increased security: Since your keys are not stored on third-party servers, the risk of hacking is greatly reduced.

- Anonymity: Your data and transactions remain private as you don’t share them with third parties.

Drawbacks of Custodial Wallets

- Security liability: If you lose your private key or seed phrase (recovery phrase), access to your funds will be lost forever.

- Difficulty for beginners: Managing keys and transactions can be tricky for those new to crypto.

Examples of non-custodial wallets

- MetaMask: A popular wallet for working with Ethereum and Ethereum-based tokens.

- Trust Wallet: Universal mobile wallet with support for multiple cryptocurrencies.

- Ledger Nano S/X: Hardware wallets that provide maximum security by storing keys offline.

What is a Custodial Wallet?

You go on a trip and decide not to carry all your cash with you, but leave it in the hotel safe. The key to the safe is held by the staff and you trust them to keep your money safe. A custodian wallet works roughly the same way.

This is a type of wallet where a third party, such as a crypto service or Exchange, stores your private keys and manages your funds on your behalf.

How Does It Work?

In a custodial wallet, you don’t have direct access to your private key. Rather, the service provider keeps them safe and takes care of all the technical aspects of managing your crypto assets.

You access your funds through a convenient interface, such as an app or website, and the provider handles everything else. Use a custodial wallet if you prefer convenience and trust a third party.

Benefits of Custodial Wallets

- Ease of Use: Perfect for beginners who want a simple and straightforward way to manage their crypto.

- Recovery Options: If you forget your password, the provider will help you recover access to your account.

- Additional Features: Many custodial wallets also offer integrated services such as trading, betting, and lending, making them a one-use solution for crypto users.

Drawbacks of Custodial Wallets

- Security Risks: Since the provider holds your private key, your funds are vulnerable to hacks or mismanagement.

- Lack of Control: You rely on the provider’s policy, which may include freezing your accounts or restricting withdrawals.

Examples of Custodial Wallets:

- Coinbase: A popular custodial wallet provider with a usable interface.

- Binance: Known for its wide range of services, among them a custodial wallet for trading and storing crypto.

- Kraken: Another trusted platform that provides custodial wallet services along with advanced trade features.

What’s The Difference Between Custodial And Non-Custodial Wallets?

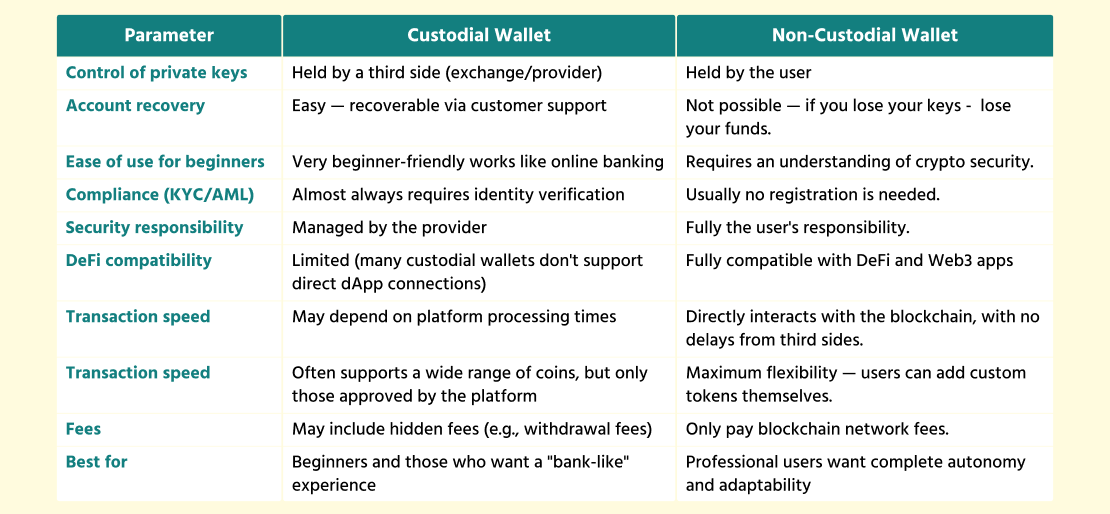

To help you better understand the difference between non-custodial and custodial wallets, we’ve prepared a clear comparison table.

This side-by-side overview highlights who controls your funds, how secure each option is, how easy they are to use, and which type of wallet might be the best fit depending on your needs — no matter if you’re looking for the best wallet for personal use or a wallet for business.

Here is a detailed comparison of key features and capabilities:

Custodial vs Non-Custodial Wallet

Cryptocurrency Wallet Development Services

If you want to create your own cryptocurrency wallet, development services can help you make this idea a reality. Whether you need a simple custodial crypto wallet for convenience or a non-custodial wallet for full control over your assets, professional developers will offer a solution to suit your needs.

What is usually included in such wallets?

- Support for popular cryptocurrencies such as Bitcoin, Ethereum, and ERC-20 tokens.

- Integration with blockchain networks and DeFi platforms for advanced features.

- Robust security: two-factor authentication (2FA), encryption, and other security measures.

- User-friendly interface that works for both mobile devices and computers.

Crypto exchanges development

Crypto exchanges are the heart of the crypto economy, the place where users buy, sell, and exchange digital assets. If you are planning to create your own exchange, development services can help you realize this project.

What is important when creating an exchange?

- Trading engine: A fast and reliable system that can handle thousands of transactions per second.

- Liquidity: Integration with large liquidity pools so users can trade without delays.

- Security: Cold storage of funds, protection from hacker attacks, and KYC/AML compliance.

- Convenience: Simple and clear interface that will suit both beginners and experienced traders.

Exchanges come in two types: centralized (CEX) and decentralized (DEX). Centralized exchanges are convenient for beginners and offer high liquidity, while decentralized exchanges give more freedom and control over their assets.

Ending Thoughts

The choice between a custodial or non-custodial wallet depends on whether you are a regular user, a crypto investor, or a business looking for a reliable tool for working with digital assets.

If you need a crypto wallet for business, especially if the company operates in a heavily regulated jurisdiction, it is better to look at custodial solutions or wallets as a service.

These are turnkey platforms with KYC/AML support, built-in fiat gateways, and the ability to add business features ranging from multi-user management to automatic reporting to tax authorities.

If your goal is personal use, maximum freedom, and access to decentralized services, then self-custodial wallets are your choice. Such wallets give full control over funds and private keys, allow you to work directly with DeFi protocols, connect to Web3 applications, and add any tokens manually. Everyone will find their pros and cons.

To summarize:

- A crypto wallet for businesses or wallets as a service with a focus on convenience, security, and compliance.

- For personal use and active crypto-enthusiasts – self-custodial wallets with full control and maximum freedom.

- For beginners and those who want simplicity and support – custodial wallets from major exchanges.

Each solution is suitable for its own tasks, and the main thing is to understand what priorities are more important to you: control or convenience, freedom or error protection, autonomy, or ready-made infrastructure.

Frequently Asked Questions

Is it possible to transfer funds from a custodial wallet to a non-custodial wallet?

Yes, it is possible. You can withdraw your funds from a custodial wallet to a non-custodial wallet by entering the address of your non-custodial wallet.

How do non-custodial wallets provide serverless security?

Non-custodial wallets use cryptography to protect private keys. These keys are only stored on your device, eliminating the risk of servers being compromised. Using non-custodial wallets require more responsibility from the user as you manage and secure your private keys yourself.

Can I use a non-custodial wallet for staking or decentralized finance (DeFi)?

Yes, many non-custodial wallets such as MetaMask or Trust Wallet support staking and integration with DeFi platforms.

Can I get back into a non-custodial wallet without a seed phrase?

No, the seed phrase is the only way to regain access to a non-custodial wallet. Should you lose it, the money will be inaccessible.

What is a crypto wallet and how does it work?

A crypto wallet is a device for storing, sending, and receiving cryptocurrencies. It works by managing private and public keys: the private key gives full access to your funds, and the public key is the wallet address where you can receive transfers. Some wallets (custodial) store the keys for you, while others (non-custodial) put control entirely in your hands.

Custodial vs Non-Custodial Wallets. How do you choose between them?

The pros, as well as cons of each option, are important to keep in mind when it comes to choosing a stored or non-stored wallet. Non-cascading wallets allow you to fully control your crypto assets, but entail greater responsibility. Castile wallets, on the contrary, offer convenience and support but require trust in the digital wallet provider.