In Q4 2024, the cryptocurrency market reached an all-time high after the US election results with pro-crypto assignments in major government roles.

This was seen in the price of Dogecoin (DOGE), which rose particularly after the Department of Government Efficiency’s statement in November 2024.

However, as the past shows, a brisk rise can be followed by an equally brisk fall. The price of Bitcoin, for example, has seen stunning ups and downs over the past two years, dropping below $20,000 (December 2022) and rising above $100,000 (December 2024).

Despite a pro-crypto stance in the US and other leading economies, cryptocurrencies are still a volatile investment product. This way, those who are willing to capitalize on virtual assets must leverage auxiliary software tools and solutions and turn to crypto trading bot development.

What Is an AI Crypto Trading Bot?

In brief, an AI crypto trading bot is a software script produced through AI development services that uses machine learning, data investigation, and other automated systems to make trading decisions.

It’s always on, continually exploring markets, spying on trading prospects, and executing buys and sells on the spot. These bots operate around the clock and never stop their activity in crypto markets.

Why Should Your Business Invest in AI Development for Crypto Trading Bots?

In 2024, the global user base of cryptocurrencies reached nearly 617 million users. If your business hopes to break into crypto too, an AI auto-trading bot could be just what you need.

First of all, bots can process tons of records in milliseconds, way faster than any human could. The finest part of their implementation, however, is that they figure out the best opportunities based on live data, not emotions, prejudgments, or external impacts.

Besides that, traders can manipulate bots as they see fit and apply complex trading bot strategies, such as trend-following or arbitrage, and instantly switch to or terminate a certain plan when the market turns south.

From the financial point of view, AI bots visibly reduce the workload and refine fund distribution. There’s no need for endless human watching because software scripts can trade non-stop without making missteps.

Lastly, bots see no difference between running a small portfolio or directing multiple accounts across different platforms. They are expandable and can grow alongside any investment range.

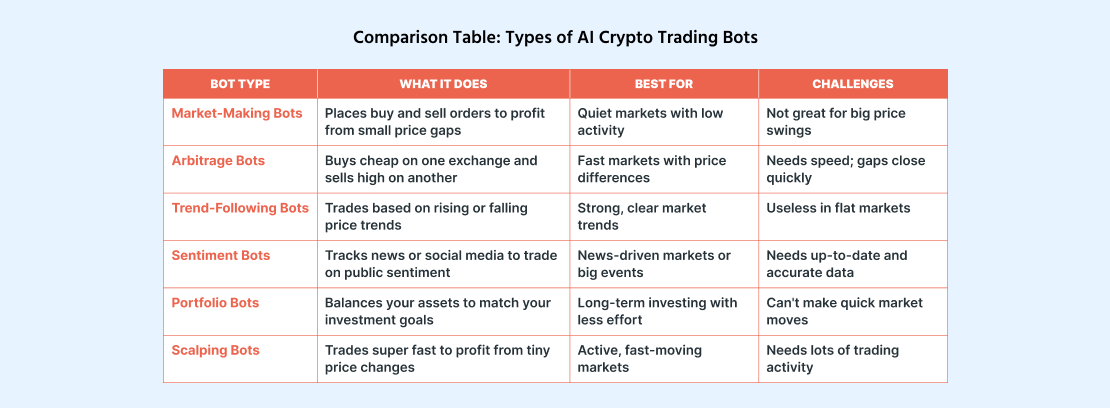

Types of AI Crypto Trading Bots

Frankly speaking, AI crypto trading bots don’t refer to a single substance. They come in different categories to hit different trading strategies and purposes:

Market-Making Bots

Market-making bots work by setting both buying and selling orders at slightly different prices. They make money off the small variation between the buy, or bid, and sell, or ask, prices. By and large, these bots are great in low-activity markets where small trades can add up over time.

Arbitrage Bots

It is a more sophisticated and straightforward algorithm that spies on price differences in different exchanges. Put simply, arbitrage bots buy an asset at a lower exchange rate and sell it at a higher rate somewhere else, which makes it a good alternative in fast-paced markets.

Trend-Following Bots

Trend-following bots, as the name implies, study price trends and trade based on whether the market is going up or down.

They are opposite to bots that forecast and depend on price fluctuation and buy when the price is heading upwards and sell when it begins dropping. Trend-following bots only work in case of extreme upward or downward movements.

Sentiment Analysis Bots

Market sentiment bots rely on existing content and information posted in open sources. A positive tone of news inclines the bot to buy an asset, while a negative tone inclines the bot to get rid of it.

This type of bot is most practical in situations where something important has happened in the market that clearly influences the audience’s behavior.

Portfolio Management Bots

Portfolio management bots keep cryptocurrency investments as balanced as possible. They automatically acquire or resell coins to maintain the desired mix of assets in your portfolio.

These bots are ideal for long-term investors who want steady growth without constantly managing their trades.

Scalping Bots

Scalping bots center around slight shifts in prices throughout the day. They accomplish many swift trades, keeping assets for only a few seconds or minutes. These small profits, over time, however, add up. Scalping bots work best in fast-moving, highly liquid markets, such as Bitcoin or Ethereum.

How to Create an AI Trading Bot: Step-by-Step Process

Creating an AI crypto bot might sound complicated, but breaking it into simple steps can make the process much easier. Here’s a clear, no-fuss guide to building your own AI-powered crypto trading bot.

Clarify Your Intentions

The first action is to figure out what you need your bot to do. Ask yourself questions like: What trading strategy will it employ? Is it going to follow market trends or look for price discrepancies across exchanges?

Also, you must decide which crypto exchanges your bot will perform on and set some ideals for how it will act. Knowing exactly what your bot should do will direct every other pick along the way.

Prepare Needments

AI needs a lot of information to learn from: past prices and trading volumes; data from news outlets, blogs, and social media in case of a sentiment-based strategy; etc. When you have your data, it’s important to clean it up, eliminate errors, or add missing information.

Find an AI Crypto Trading Bot Development Company

If you don’t have the technical expertise to make the bot yourself, it’s better to outsource your project to an external provider that offers cryptocurrency development services as part of their core expertise.

Experienced developers can steer all the complex aspects, such as programming, machine learning, and system integration. Besides that, working with the right companion can save time and lead to a better-quality product.

Integrate with Crypto Exchanges

When a bot is ready to trade, it needs to connect to the crypto exchanges where it will operate. You’ll integrate the exchange’s API so your bot can get up-to-date market information, make purchases, and sell coins.

Probe and Polish

Before you trust your bot with real money, probe it in a simulated environment to see if it works without any glitches in communication. When you’re confident it’s acting well, use a small amount of actual funds to see how it performs in the real market.

Deploy and Watch

Finally, deploy your bot script to trade in real markets. But don’t walk away completely—watch its behavior and look out for any problems that might pop up.

Features of a High-Performance AI Crypto Trading Bot

A high-performance AI crypto trading bot app needs to have many features to get the most out of market discrepancies.

First, it must be able to interpret market data on the fly and process the latest information to find applicable trading options—in simple terms—quickly adjust to any shifts in the market and earn on them.

Backtesting is another must-have. It allows traders to test how the bot will perform on past market data before trading with real assets.

Don’t neglect strong risk governance features, such as automatic stop-loss, which helps cap your losses if the market goes the wrong path. Besides, it should be able to trade on many exchanges, leaving you with more options to play with.

Since crypto markets never rest, your bot must run all day, every day, sending you updates, notifications, and warnings so you can watch movements whenever you want.

And of course, security is out of the question—the bot should use encryption and safe APIs to protect your money and personal info.

How SCAND Can Help You Build an AI Crypto Trading Bot

Are you overwhelmed by the number of options for software development companies and are unsure about your choice? SCAND is here to help you make the impeccable AI crypto trading bot.

With over 20 years of experience in software development and deep knowledge of AI and machine learning, we know how to create software scripts that get results, be it a bot designed for specific strategies or one that’s versatile.

We carry out everything—from brainstorming and research to machine learning development and deployment—so you don’t have to stress about a thing. Our bots can tolerate heavy trade volumes with no hiccups.

Plus, when your bot is live, our team is always ready to support you and tweak it for top performance as markets alter.

Whether you’re just starting out in crypto or running a financial powerhouse, SCAND can create a trading bot that suits your goals.

Common Challenges in Developing AI Crypto Trading Bots

Unfortunately, cryptobots are not without their flaws. One of the biggest obstacles is price fluctuations. Although this drawback does not apply so much to bots as to the industry as a whole, it can significantly affect the work of the bot.

The prices of cryptos can go high and low, which means the bot must be strong enough to withstand changes in conditions that are hard to predict.

At the same level, it is vital to maintain information cleanliness. If the data used is unclean or contains a lot of mistakes and inaccuracies, then the conclusions made by the bot will make no sense.

Another concern is the overfitting of algorithms wherein the bot becomes excessively reliant on historical data patterns and becomes unable to successfully trade in real-time.

It is crucial to achieve the right balance between making use of historical data and being dynamic enough to adapt to live circumstances.

Trends to Expect in AI Crypto Trading Bot Development

In the future, bots are expected to see more exciting advances. For instance, they’ll use deep learning models to inspect complex data and make even more accurate market predictions.

Another incredible trend will be live sentiment investigation, allowing them to watch breaking news and follow social media trends to react to market changes.

Cloud-based bots will likely become the norm, offering faster performance, fast expandability, and independence from high-powered hardware.

Costs and Timelines for Developing an AI Crypto Trading Bot

The cost and time it takes to make an AI crypto trading bot app can vary a lot based on some metrics.

First, how complex the bot is makes a huge contrast—advanced AI or integrating it with lots of cryptocurrency trading platforms can add time and double expenses.

Then goes the team you hire—experienced developers might charge more, but they’ll usually deliver faster and more satisfying results.

You’ll also need to factor in gathering and prepping historical data, which takes time. And don’t forget to test and polish the bot to prove it works in real market situations, which can add extra time.

On average, building a trading bot takes around 2 to 6 months, and the costs typically fall between $20,000 and $100,000, depending on what you want it to do.

FAQs

How much time does it normally take to develop an AI crypto trading bot?

Development usually takes 2–6 months, depending on the complexness of the bot.

What are the best technologies for AI auto-trading bot development?

Python, JavaScript, and C++ are widely used to build AI trading bots.

How can I link my bot to crypto exchanges?

Trading bots connect to exchanges via different APIs provided by Binance or Coinbase, for example.

Is it legal to use an AI crypto trading bot?

Yes, using trading bots is legal, but make sure you don’t breach any regional regulations.

Can I use machine learning in my crypto trading bot?

Absolutely. ML algorithms improve predictive precision and decision-making.

Can SCAND develop bots for specific trading strategies?

Yes, SCAND builds fully customizable bots crafted to your business necessities.

How does SCAND provide data security for trading bots?

We add advanced encryption, secure APIs, and comprehensive testing to maintain information security and law adherence.