In the DeFi world, seconds count: the first person who buys a token when it is listed gets the biggest profit. This is why crypto sniper trading bots are created — smart algorithms that react faster than any human. In this article, we tell you how sniper bots work, where they are used, and why they have become a must-have tool for advanced traders.

What Is a Crypto Sniper Bot?

A crypto sniper bot is an automated tool designed to automate instant token purchases as they appear on decentralized exchanges (DEX) such as Uniswap, PancakeSwap, and others.

Unlike a regular trader who has to manually track the token launch, confirm the transaction, and hope no one beats him to it, the sniper bot acts in a split second.

It continuously scans the blockchain, detects the appearance of new tokens, and immediately sends a transaction to buy, often before the listing information reaches the screens of regular users.

Where Does the Crypto Sniper Bot Apply?

Such bots are most actively used on decentralized exchanges, especially in the Ethereum and Binance Smart Chain ecosystems. Some of the popular platforms are:

- Uniswap is the most prominent DEX on the Ethereum blockchain and is constantly adding hundreds of new tokens each day.

- PancakeSwap is the main DEX on the Binance Smart Chain, which has really fast block speeds along with ultra-low transaction fees, which is especially good for bots.

- QuickSwap, SushiSwap, and Trader Joe’s are other DEX platforms where bots can be used to quickly enter new projects.

Bots integrate with the blockchain directly, using a Web3 interface and interacting with exchange contracts, bypassing the user interface.

Why Are Sniper Bots Important for DeFi Traders?

When a cryptocurrency project launches, the token price can be very low at the beginning. But very quickly, it can shoot up seconds or minutes, and at just that moment, a sniper bot lets you be in the early ranks of buyers.

For DeFi traders, this means:

- Opportunity to earn quickly and a lot if the project is successful.

- Competitive advantage: It is impossible to act as fast manually, even when fully prepared.

- Risk automation: A bot can be configured to immediately sell a token if the price falls sharply, or vice versa — to lock in a profit when the price rises.

However, it is important to understand that there are risks in the use of such bots: attackers can issue fake tokens with tricks in smart contracts (e.g., banning them from sale).

According to Chainalysis data reported by CoinDesk, rug pull scams in DeFi caused over $2.8 billion in investor losses in 2021 alone, underscoring the critical need for smart contract auditing and robust bot protection mechanisms.

Therefore, creating and customizing a sniper bot requires deep knowledge of DeFi, Web3, and smart contract security.

How a Sniper Bot Operates (Step by Step)

Sniper bot is not just a script, but a complex system that interacts with the blockchain directly. Its main goal is to be the first to buy a token as soon as it appears on a decentralized exchange. To achieve this, the bot performs several coordinated actions in a matter of seconds. Here’s how it works.

Liquidity Pool Monitoring

It all starts with monitoring liquidity pools. On DEX platforms such as Uniswap or PancakeSwap, token trading starts after the creation of a liquidity pool — a token pair such as ETH/NEW or BNB/NEW.

The sniper bot constantly monitors events on the blockchain (e.g., by subscribing to smart contracts events via a Web3 interface), and as soon as it notices the addition of a new pool or the replenishment of an existing one with liquidity, it recognizes that trading has begun.

Sending High Gas Transactions

Then comes the critical stage — the fastest way to send a transaction to buy a token. In order to outrun other traders and bots, the sniper charges a higher gas fee, often at a level comparable to that of miners/validators.

This increases the chance that his transaction will be the first to be executed in the nearest block. At the time of launching a new token, a few seconds difference can be worth lost revenue or a complete failure.

Automated Sale

The next step is to automatically sell the token if the price has risen to a given level. This is part of a strategy called “snipe and flip”: buy at the start, wait for growth, and lock in profits.

A smart bot can be configured to automatically sell under several conditions, for example, when a certain price is reached, when trading volume spikes, or even on a timer (X minutes after purchase).

This helps to minimize the human factor and exit the trade in time, especially in the case of “pump and dump” scenarios, making it a vital component of modern trading strategies.

The Role of Web3 and Smart Contracts

Web3 infrastructure and smart contracts play a key role in the operation of a sniper bot. Through Web3 (for example, using libraries like Web3.js or Ethers.js), the bot connects to the blockchain, interacts with exchange contracts, sends transactions, tracks events, and receives data in real time.

Not all actions take place through a browser interface but through direct API interaction with the network.

In addition, the bot can analyze the smart contract of the token itself before buying it to make sure it doesn’t contain malicious features such as a selling ban, 99% commissions, and other traps.

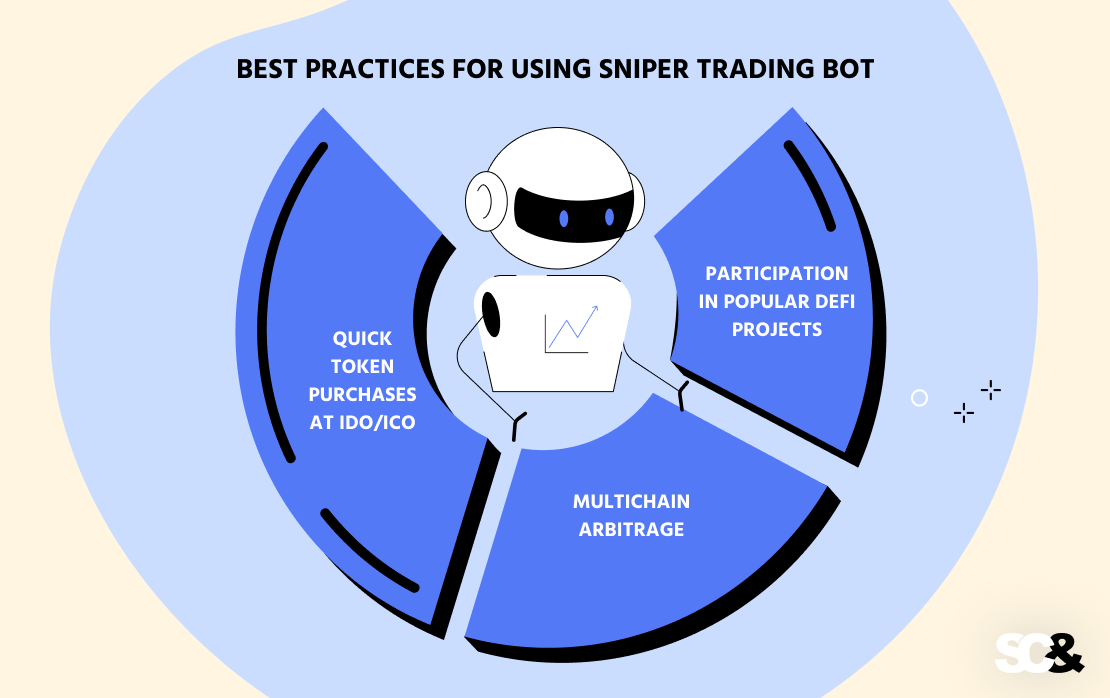

Best Practices for Using Sniper Trading Bot

Long gone from a “quick start” tool, automated trading has become a universal solution for traders wishing to maximize distributed markets. Here are three main areas where such bots are particularly useful:

Quick Token Purchases at IDO/ICO

One of the most popular scenarios is participation in initial token offerings (Initial DEX Offering or Initial Coin Offering). In such launches, every second counts: a token can grow in value 5, 10, or even 100 times within the first minutes after listing.

Sniper-bot allows you to not just buy quickly, but enter the transaction before most participants see the token on the screen. It tracks the moment liquidity is added and sends the transaction instantly, making it an essential tool for those hunting for early entry.

Multichain Arbitrage

Prices for the same token can vary across different blockchains or decentralized exchanges. Especially in high-volatility environments.

Sniper bots can be adapted to an arbitrage strategy, where the bot automatically detects the difference in price of one token between two DEXs (e.g., Uniswap and PancakeSwap) and makes parallel buy and sell trades. If properly configured, it allows you to make money on price differences almost without user participation.

Participation in Popular DeFi Projects

The world of decentralized finance is changing rapidly: new tokens, meme projects, yield farming programs, NFT pools, etc. are appearing pretty often. At the moment of the hype, minutes and sometimes even seconds decide everything.

Sniper-bot helps enter a trending project as early as possible, minimize risks, and promptly exit when profit is achieved. This is especially important for projects with anonymous teams, where it is important not only to enter quickly but also to be able to quickly “jump out” without waiting for the price to fall.

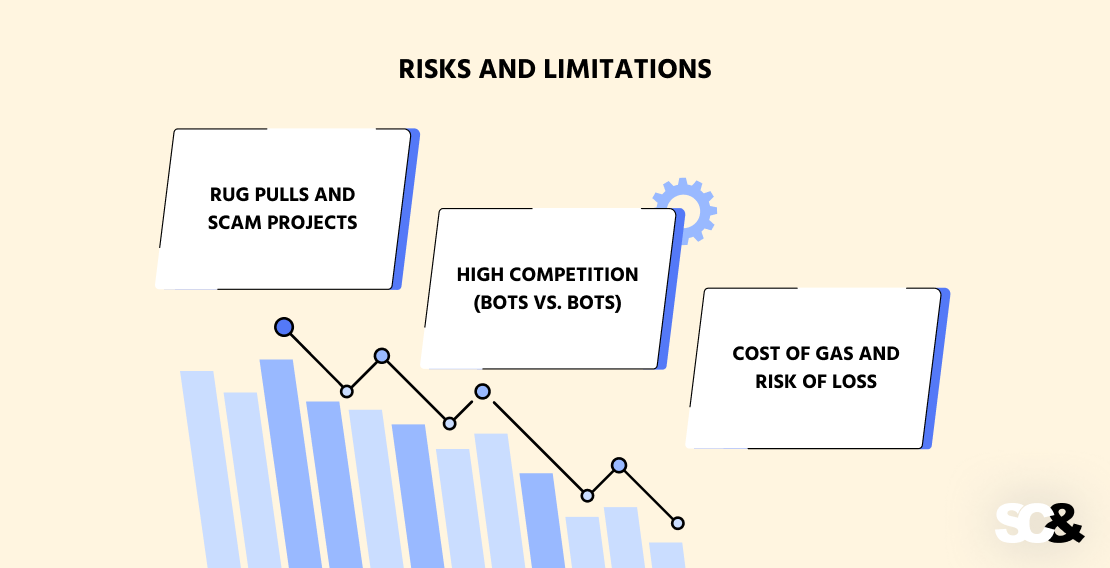

Risks and Limitations

Though DeFi sniper bots have great powers, they have some limitations and several risk factors.

Rug Pulls and Scam Projects

Using sniper bots carries one of the most major risks, particularly in relation to so-called rug pulls and participation in scam systems.

These are situations where token creators launch a project, create a pool of liquidity, and wait for bots and traders to start buying up the token. After that, they instantly withdraw all liquidity, leaving investors with devalued or unsellable tokens.

Frequently, hackers incorporate secret features into a smart contract: a ban on selling, large commissions, address spoofing, and other methods making the token absolutely useless for trading. Therefore, using cryptocurrency trading bots without analyzing the contract beforehand can lead to an instant loss of funds.

High Competition (Bots vs. Bots)

On popular DEX platforms, especially during the launch of new tokens, competition between trading bots is extremely high. Every bot strives to get into the first block with a purchase, and literally split seconds decide the outcome of the transaction. Aggressive strategies are used — from maximizing gas fees to sending several transactions simultaneously.

In such an environment, a poorly configured bot or a slow system response can result in a transaction failing or being delayed, at an inflated price. Competition between bots is a technology race, and it is not only the fastest but also the most sophisticated algorithm that wins.

Cost of Gas and Risk of Loss

A crypto trading bot has to play ahead of the curve, and in order to outmaneuver other network participants, it has to set high commissions, especially in networks such as Ethereum, where the price of gas sometimes soars to dozens of dollars per transaction.

But if the token does not live up to expectations and does not grow, the trader finds themselves at a double disadvantage: they lose both on the purchase of the asset itself and on commissions, which cannot be recovered.

The situation becomes more complicated when the bot sends several transactions in parallel — in case one of them fails. It would seem to be a live-saver, but in reality, it can go wrong: some transactions work but do not bring profit, and commissions eat up the balance.

For those who work with small amounts or catch moments of high volatility, such risks are especially sensitive — one mistake can cost a significant part of the deposit.

In the table below, we have systematized the key capabilities and limitations of the crypto trading bot for clarity:

| Advantages | Risks |

| Instant entry into the token at launch, before information is available to the general audience | Possibility to get into a rug pull or scam project with a ban on selling or withdrawing liquidity |

| High-profit potential if the token is successfully launched | High competition between bots, where whoever is faster and pays more for gas wins |

| Full automation of the buying and selling process | Substantial gas costs, especially in Ethereum, serious losses are possible if the deal fails |

| Flexible customization of strategies: buy levels, sell levels, contract verification | Requires a technical background to customize and understand Web3 architecture and smart contracts |

Strengths and Risks of Sniper Bots

Crypto Trading Bot Development Process

The main task of bots is to react as quickly as possible to the appearance of new tokens on decentralized exchanges and buy the asset at the best price.

Such solutions are especially relevant in the era of the rapidly developing DeFi sector and high competition among traders and algorithms. So how the sniper bot is organized, what technologies are used in its creation, and how does the SCAND team work with it?

Technical Stack: Web3, Python/Node.js, Solidity

At the heart of any sniper bot is interaction with the blockchain via Web3. Depending on the project, we at SCAND use both Python with Web3.py and Node.js with Web3.js. This allows us to realize a flexible architecture adapted to different blockchains and exchanges.

When it is necessary to create advanced logic or automate entire chains of operations, we use Solidity and develop our own smart contracts. This approach allows us to realize more precise control over the execution of transactions and increase the bot’s responsiveness.

Integration with Uniswap, PancakeSwap, and other DEXs

Sniperbot interacts directly with decentralized exchanges, such as Uniswap, PancakeSwap, and SushiSwap. These platforms are powered by smart contracts that openly publish their interfaces. Through the Web3 interface, a bot tracks events like the creation of a new token pair or the emergence of liquidity.

The moment a transaction opportunity arises, the bot calculates the right amount of tokens through functions like getAmountsOut and sends a pre-signed transaction. By automating and customizing the gas parameters, the bot is able to overtake manually sent transactions and be among the first.

Front-Running, MEV, and Attack Protection

One of the most sensitive areas of sniper bots is the handling of front-running and MEV (Maximal Extractable Value) strategies.

We are highly attuned to these aspects, especially defense against sandwich attacks and other mempool manipulations. The bot monitors pending on-chain transactions, learns from market conditions, and even makes a request autonomously with higher priority.

To ensure things get more dependable, we also employ private channels of transaction delivery, for example, via Flashbots. This protects the client’s strategy from external interference and maintains a competitive advantage.

Security and Key Protection

In any crypto trading bot project, security is key. We never store private keys in code but use secure environment variables or external storage. We incorporate hardware wallets or hardware security modules (HSM) if required.

Additionally, we implement proxies and rate limits to avoid blocking by RPC providers and to keep the bot stable. Our projects keep detailed logging of all operations: from trying to connect to DEX to successful and unsuccessful transactions.

Why Work with a Sniper Bot Development Company

At first glance, the idea of independent development may seem attractive: open APIs, many ready-made libraries, access to RPC nodes, and smart contracts. However, the external simplicity hides dozens of technical and infrastructural risks that make working on such a project extremely difficult without professional experience.

Risks of Self-Development

One of the biggest mistakes enthusiasts and novice developers make is underestimating the complexity of interacting with the blockchain in real time.

In a highly competitive environment, even milliseconds decide whether your transaction will get into the right block. For a bot to work stably, you need not only to process mempool data correctly but also to manage the gas, adjust to the network’s state, and avoid frontrunning by other participants.

Why Expertise in Smart Contracts and Blockchain Networks Matters

The real effectiveness of a sniper bot is only apparent when its architecture is built on deep blockchain experience. This applies both to the low-level understanding of transaction and mempool logic and proper integration with Uniswap, PancakeSwap, SushiSwap, and other DEXs.

Experience with smart contracts is critical here: it is often necessary not only to use standard swap functions but also to develop custom contracts to protect against sandwich attacks, frontrunning, or automating multi-transactions.

Knowledge of gas optimization and working with private channels (e.g., Flashbots) is also important, especially when it comes to fighting for fractions of a second.

Crypto Trading Bot Development Company SCAND

The SCAND team has years of experience in bot development services, building custom crypto trading bots, AI-driven systems, and smart contracts tailored to various business needs. We specialize in projects where speed, security, and adaptability are critical — exactly the qualities needed for crypto traders in the fast-moving crypto market.

Our experts have developed NFT sniper bots capable of detecting and reacting to liquidity events on crypto exchanges like Uniswap in under 0.5 seconds.

To ensure secure and effective trading, we implement proven solutions for safeguarding private keys, using proxies, managing backup RPC endpoints, and logging all system activities.

SCAND also develops and audits smart contracts written in Solidity to guarantee the safety of client funds and stable bot performance. We can even integrate your automated trading systems with a Telegram bot interface for real-time alerts or interaction, further enhancing operational control.

If you’re searching for sniper bot development services, SCAND is here to help. We’ll create a custom trading strategies solution designed to optimize performance, execute trades efficiently, and help you stay ahead in a competitive market.